Description

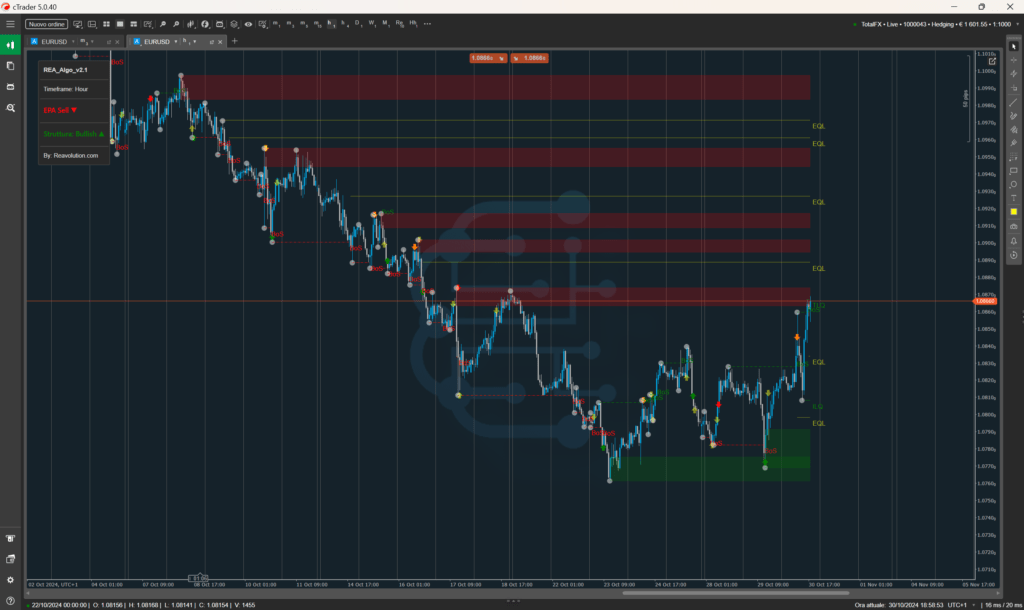

The Elliott theory is among the best known and most applied in trading strategies. These are indicators that can be obtained from the graph of a stock which predict its development phases with a certain accuracy. This theory allows you to calculate trend signals (such as trend lines or support and resistance lines) which are extremely useful for understanding the influence of the human factor on financial markets.

Elliott waves, in fact, allow us to predict both macro and micro the pattern of variations in prices, both for macroscopic and microscopic analyses, it is made up of cells that constantly repeat. Each cell, called a "wave", is made up of 8 movements and characterized by an impulse, increasing or decreasing.

The pattern generally requires that the five basic waves, called impulse, follow one another constantly, alternating at most with one correction, and that at the end of these there is a trend reversal, anticipated by three other corrective waves.

Elliott waves can be traced both with long periods and with particularly short periods. The choice of which division into periods to adopt falls exclusively on the type of operation you want to maintain: short periods are suitable for intra day online trading, long periods for long-term strategies.