Description

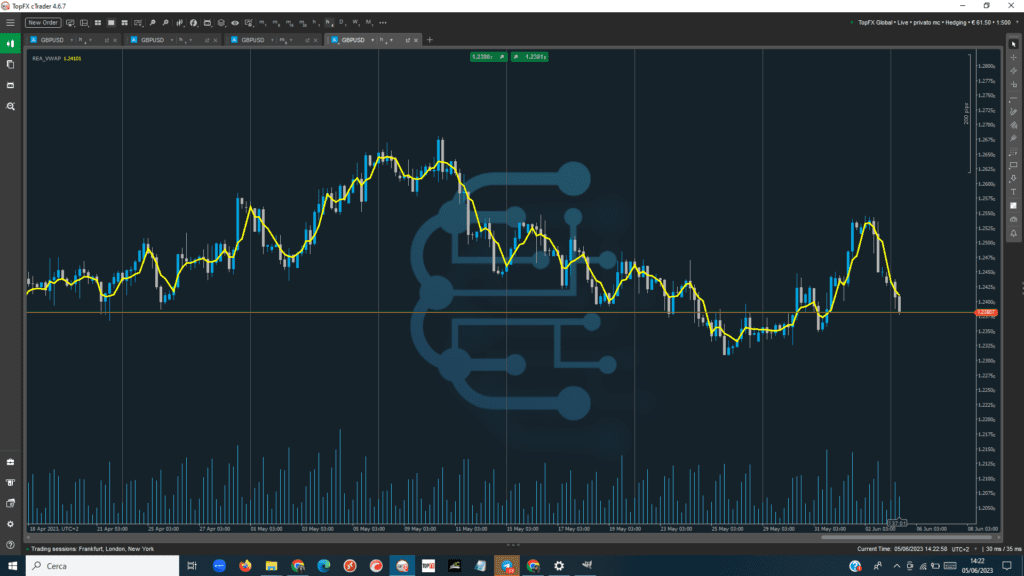

Volume Weighted Average Price (VWAP) is a technical analysis indicator used on intraday charts that resets to zero at the start of each new trading session. It is a trading benchmark that represents the average price at which a stock traded during the day, based on both volume and price.

VWAP is important because it provides traders with price information on both the trend and value of a stock.

It is used in several ways by traders. in fact, you can use the VWAP as a trend confirmation tool and build trading rules around it. For example, stocks priced below the VWAP may be considered undervalued and stocks priced above it as overvalued.

If prices below it move above, traders can go long the stock. If prices above the VWAP move below it, they can sell their positions or initiate short positions. Institutional buyers, including mutual funds, use VWAP to help get into or out of stocks with as small a market impact as possible. Therefore, when they can, institutions will look to buy below the VWAP or sell above it. This way their actions push the price towards the average, rather than away from it.

VWAP's incorporation of volume is valuable to traders for what it can indicate about the degree of trading activity during short periods of time, regardless of whether competitors are opening or closing positions